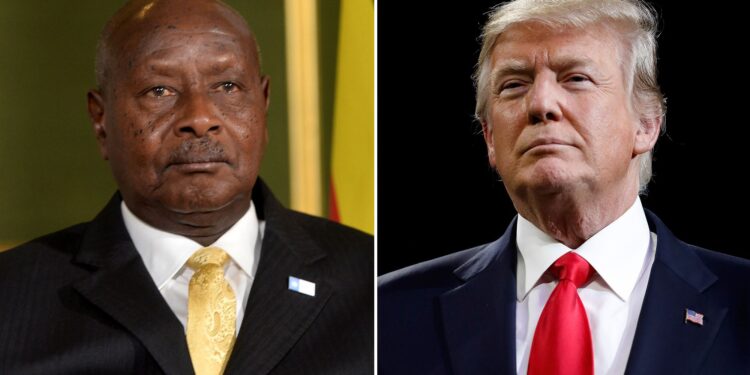

Kampala — President Yoweri Museveni has supported calls for the Bank of Uganda (BoU) to slow down and soften its licensing drive targeting large Savings and Credit Cooperative Organisations (SACCOs), signalling possible political intervention in a growing regulatory dispute.

The President’s position emerged after a series of high-level meetings involving leaders of major SACCOs, the Uganda Cooperative Alliance, and lawyers from Kampala Associated Advocates (KAA). The engagements included discussions with the Speaker of Parliament and later a meeting at State House in Entebbe.

According to KAA, which led the consultations, the talks focused on concerns raised by SACCOs over BoU’s recent circulars and enforcement actions. The central bank is seeking to license large SACCOs under the Microfinance Deposit-Taking Institutions (MDI) framework.

KAA said the discussions were “positive,” with President Museveni agreeing that BoU should first ease its licensing efforts to allow wider consultations and legal harmonisation.

“The team strongly submitted that before SACCOs are licensed by the Bank of Uganda, the laws must be harmonised to reflect the unique nature of SACCOs as member-owned, member-funded, member-managed, and member-beneficiary institutions,” KAA said in a statement.

Distinct model, different risks

SACCO leaders argue that cooperatives should not be regulated in the same way as commercial banks or microfinance institutions. They say SACCOs operate on a grassroots, member-driven model and play a critical role in expanding access to affordable credit, particularly in rural and peri-urban communities.

Sector players warn that heavy regulation could weaken cooperatives and undermine government efforts to support economic growth through community-based financial systems.

In addition to regulatory concerns, President Museveni reportedly backed calls to extend the tax holiday for SACCOs, which is set to expire next year. Industry leaders say an extension would help stabilise the sector as regulatory and legal questions are addressed.

Regulatory tension

The President’s position contrasts with a recent directive by Attorney General Kiryowa Kiwanuka, who advised BoU, the Ministry of Trade, Industry and Cooperatives, and the Ministry of Finance to halt operations of large SACCOs that have not obtained licences.

BoU maintains that at least 99 SACCOs meet the legal thresholds requiring central bank supervision. However, only a small number have applied for licences, raising concerns over financial stability, consumer protection, and anti-money laundering compliance.

What lies ahead

President Museveni’s call for a phased and consultative approach now places pressure on regulators and policymakers to balance strict legal enforcement with political and socio-economic realities.

As Parliament, BoU, and sector stakeholders consider the next steps, the SACCO industry — which serves millions of Ugandans — remains in limbo, facing uncertainty over regulation and the risk of operational disruption. The possibility of legislative amendments or new policy guidance is now firmly on the table.